SPECIALIST ACCOUNTANT & TAX SERVICE FOR PROPERTY INVESTORS. TRANSPARENT, AFFORDABLE FIXED FEE

AAT Accounting is a specialist accounting practice for the property industry. We provide income tax, GST, and accounting services to real estate agents, with specialist advice and systems that save you time and money, all for a transparent, affordable fixed monthly fee - no surprises!

ABOUT US

Client-Centric Support

We provide specialist tax and accounting services to clients in the NZ property sector since 2014. As a practice that only serves the property industry, AAT Accounting provides truly specialist advice. Better knowledge of the legal fish-hooks than general business accountants, and a deep network throughout the industry to serve your needs best.

RESIDENTIALS PROPERTY INVESTMENT

Get your free PDF Guide on what you can or can't claim

OUR SERVICES

High Quality Services

Tax Compliance

Tax Compliance in New Zealand relies on a self-assessment system. This means you are responsible for calculating and filing your own tax returns. If you fail to do so, or do so incorrectly, there’s a chance no one will ever know – or there’s a chance you’ll be caught and face significant financial penalties. Not knowing your responsibilities is no excuse.

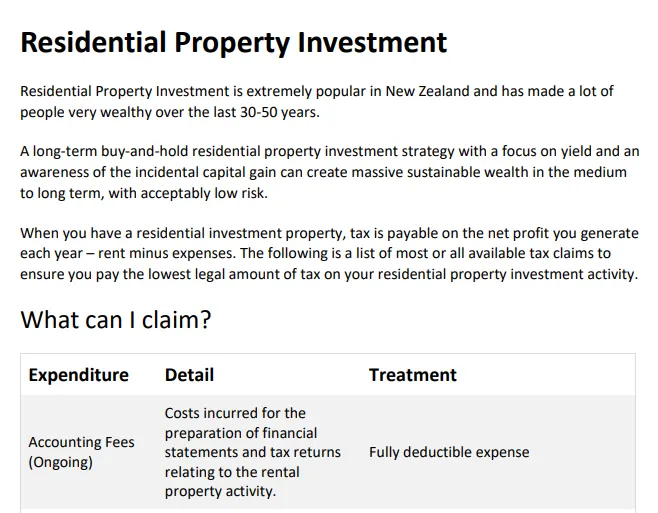

Residential Property

Residential Property Investment is extremely popular in New Zealand and has made a lot of people very wealthy over the last 30-50 years.

Real Estate Agent

We can help with real estate agent accounting and bookkeeping services regardless of where you are based in New Zealand, and no matter which agency you’re connected to. We know how important it is to have an accountant who understands the industry you work in – you don’t need to explain how your commission payouts work or why your vehicle claim is so high.

Property Accounting

Investment in residential property (houses) and commercial property (offices, warehouses, retail space, industrial) in New Zealand has been a popular option for the building of wealth for decades, and with low investment returns elsewhere, it doesn’t seem likely to change any time soon.

Our Benefits

Specialisation

Because we only serve property clients, all our systems and templates are custom-built with property clients in mind.

Also; because we deal with property all the time, our understanding of the complex and changeable property tax landscape will always be up to date. Whether it’s setting up the right structure, or understanding what new laws mean for your business, you can trust that AAT are on the case.

Communication

As part of keeping costs low, all business is done remotely. Email is the primary form of communication, with rare video- or phone-calls as needs arise. Standard response times are usually excellent; always aiming to pleasantly surprise.

No additional charges for general day-to-day email queries. Clients are encouraged to make contact before entering into any significant arrangements or transactions. This service is not only free, it is priceless.

Fixed Fee Structure

Due to low overheads including operating digitally, fixed fees are set at very competitive rates. There is no GST added to our stated prices for non-registered clients such as residential property investors – a significant saving.

Check our Fixed Price Calculator to confirm the price that applies to you.

Speed

Engagements are processed in the order in which their records are received. We aim to complete all work promptly, though during busy times of the year there can be delays.

Need to jump the queue? In an emergency work can be completed under extreme urgency (less than a week) at additional cost.

Our Happy Clients

Our Partners

Chartered Accountant

Registered Chartered Accountants with Chartered Accountants Australia and New Zealand (CAANZ) gives the assurance that the very high professional standards of education and training have been met, and that continuing professional development is occurring every year to ensure knowledge is up to date!

Tax Agency

Being a registered tax agency with New Zealand’s Inland Revenue Department (IRD) provides clients with an eight-month extension of time for filing their income tax returns from July to the following March. The extension also delays the tax payment date two months from February to April. On top of all that, we deal with the IRD direct on your behalf.

Xero Certified

Xero provides, in their words, Beautiful Accounting Software. We thoroughly agree. Xero is not a requirement, but is strongly encouraged. Xero fees are additional to fixed fees quoted, but provide reporting benefits and bookkeeping time-savings well in excess of the cost.

Property Investors

Most accountants don’t invest in property. How can they best advise investors? Anthony Appleton-Tattersall, Director of AAT Accounting Services is an active investor owning real estate throughout New Zealand, including apartments, standalone houses, and shares in commercial property syndicates.